HSBC profits hit by $2.1bn charge on Chinese bank stake

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Pre-tax profits at Europe’s largest lender HSBC fell 29 per cent year-on-year to $6.3bn in its second quarter, as it recorded a $2.1bn impairment related to its stake in China’s Bank of Communications.

The figure was higher than the bank’s previous warning of a paper loss of up to $1.6bn, following BoCom’s announcement of a plan to issue up to Rmb120bn of shares as part of a recapitalisation plan, diluting HSBC’s stake from 19 per cent to 16 per cent.

Analysts had expected profits of $6.99bn, according to consensus figures compiled by the bank.

Net interest income, the difference between the interest paid to clients and what the bank earns on lending, was $8.5bn. The bank’s return on average tangible equity, a measure of profitability, was 14.7 per cent in the first 6 months of the year, higher than analyst expectations of 12.8 per cent.

The lender warned in its outlook that profitability risked an indirect hit from President Donald Trump’s tariff regime in the coming years.

“While we would expect the direct impact from tariffs to have a relatively modest impact on our revenue, the broader macroeconomic deterioration may see [return on tangible equity] excluding notable items fall outside of our mid-teens targeted range in future years,” it said in a statement.

The Asia-focused bank announced a second interim dividend of 10 cents a share and another share buyback of up to $3bn, meaning it has launched programmes returning $9.5bn to shareholders in the first half of 2025.

The bank’s wealth segment drove its non-interest income growth, with revenues from its international wealth and premier banking group up 19 per cent on a constant currency basis in the first half of 2025.

This was led by the private bank’s brokerage benefiting from wealthy clients increasing their trading activity, as well as new business growth in insurance.

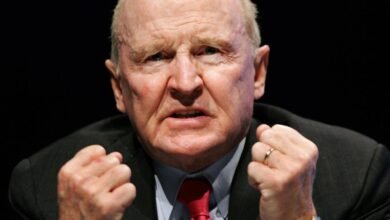

The bank said it remained “on track” to achieve $1.5bn in annualised cost savings by 2027 — a key element of chief executive Georges Elhedery’s restructuring, which has cost the bank $0.6bn so far in 2025.

Elhedery has carried out sweeping reforms at the bank since last September, including a merger of its corporate and remaining investment banking units and an exit from businesses where it did not consider itself a market leader, such as banking in Canada and investment banking in the US.

“We’re making positive progress in becoming a simple, more agile, focused organisation built on our core strengths,” said Elhedery. “We continue to navigate this period of economic uncertainty and market volatility from a position of strength, putting the changing needs of our customers at the heart of everything we do.”

The FT has previously reported that Europe’s largest lender has been forced to make a second sweep of candidates to replace Sir Mark Tucker as chair as it struggled to find enough suitable candidates.

The London and Hong Kong-listed bank has not ruled out appointing one of its current board members to the role if it cannot find a suitable candidate. Brendan Nelson will take over as interim chair on October 1, when Tucker leaves for insurer AIA.

https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F74f1cae2-8470-469e-9064-1f57a0214f08.jpg?source=next-article&fit=scale-down&quality=highest&width=700&dpr=1

2025-07-30 04:35:43